Girl.. It's Time to Get in Your (Budgeting) Bag

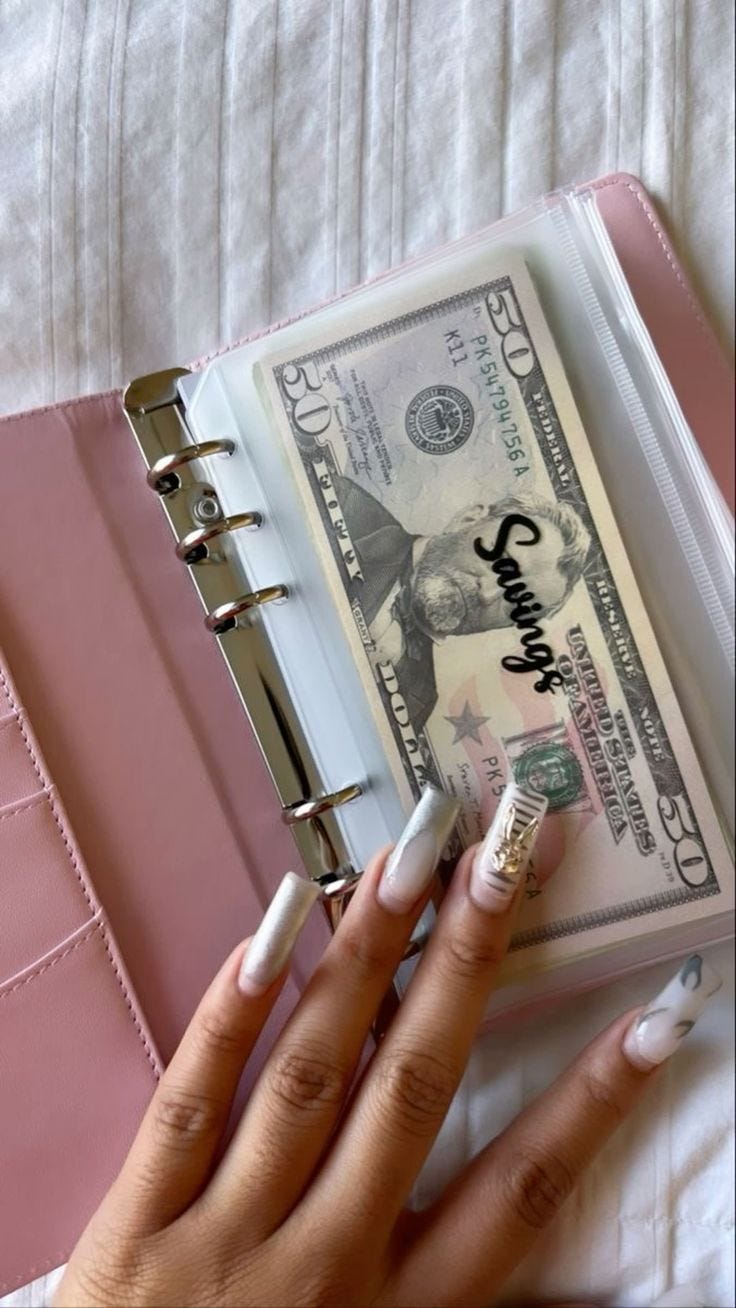

We want more women to be financially independent, so start learning to budget your income.

Budgeting 101: A Beginner's Guide

Do you find your money vanishing the moment it hits your account? Ever catch yourself wondering, “Where on earth did it all go?” Trust us, you’re not alone!

Enter the superhero of personal finance: budgeting. Crafting and sticking to a budget is a game-changer. It lets you track where your cash flows from, save for those big dreams, and ensure you don’t blow your hard-earned money on impulse buys.

So, What is Budgeting?

Think of budgeting as your personal financial roadmap. It’s the process of planning and managing your income and expenses. By setting a budget, you allocate funds for necessities, fun splurges, and future savings, giving every naira(insert currency here) a purpose. It’s your secret weapon to staying in control and reaching your financial goals.

Many people benefit from seeing where their money goes each month. A budget empowers you to take control of your finances, making it easier to save for your aspirations. The key is finding a method to track your finances that suits your lifestyle.

Essential Steps to Create a Budget

Track Your Net Income

Start by recording all sources of income; be it your job, side gigs, or other income streams. This gives you a clear picture of your financial situation.

When setting up a budget, your net income—what you bring home after taxes and deductions like retirement contributions and health insurance—is the starting point. This figure is crucial because it represents the actual money you have available to spend.

For freelancers, gig workers, contractors, and those who are self-employed, tracking net income is especially important due to the irregularity of earnings. It's essential to keep detailed records of contracts and payments to manage these fluctuations effectively. This practice helps you accurately assess your financial resources and make informed decisions about budget allocations.

By focusing on net income and maintaining organized financial records, you can create a budget that reflects your real financial situation.

Track and Categorize Your Expenses

Understanding where your money goes is essential when creating a budget. Start by categorizing your expenses into fixed and variable categories. Fixed expenses are regular bills like rent, utilities, and car payments, while variable expenses can fluctuate monthly, covering groceries, gas, fuel, entertainment, and discretionary spending.

To track your spending effectively, choose a method that suits you—a notebook, a budgeting app, or online tools. Reviewing credit card and bank statements and noting all physical money exchanges can provide detailed insights into your monthly expenditures.

Set Financial Goals

Setting clear financial goals is crucial for effective budgeting. Start by identifying both short-term and long-term objectives that are meaningful to you. Short-term goals could include saving for a vacation, purchasing a new computer, or paying off some debt. Long-term goals might involve building an emergency fund, saving for a down payment on a home or car, or investing for retirement.

When determining your priorities, consider what matters most to you personally and financially. This process helps you allocate your income in a way that directly supports these goals. For instance, if travel is a passion, prioritizing savings for vacations ensures you can enjoy those experiences without financial stress. On the other hand, focusing on debt repayment frees up resources for future investments or savings.

By clearly defining and prioritizing your financial goals, you establish a roadmap for your budget that guides your spending decisions and motivates you to stay disciplined in achieving your aspirations.

Create a Plan

Allocate your income to each category with careful consideration, ensuring you prioritize essentials and savings to achieve financial stability and growth. The 50/30/20 rule offers a helpful guideline:

Essentials (50%): This category covers necessities such as housing costs (rent or mortgage payments), utilities (electricity, water, internet), transportation (car payments, fuel, public transit), groceries, and insurance premiums. These expenses are crucial for daily living and should be prioritized to maintain stability.

Wants (30%): Allocate 30% of your income to discretionary spending, which includes non-essential items like dining out, entertainment, shopping for non-essential items, and hobbies. While these expenses can enhance your quality of life, they should be managed carefully to ensure they don’t exceed your budgeted amount.

Savings and Debt Repayment (20%): Reserve 20% of your income for savings and debt repayment. This includes building an emergency fund to cover unexpected expenses, saving for future goals and paying down any outstanding debts (credit cards, loans). Prioritizing this category helps you build financial security and work towards long-term financial goals.

Monitor and Adjust

Regularly monitoring your spending is essential for maintaining financial discipline and ensuring your budget stays on track.

Here’s how you can effectively manage and adjust your budget over time:

Begin by keeping a close eye on where your money goes. Regularly review your bank statements, credit card transactions, and receipts to understand your spending patterns. This helps you identify any discrepancies between your budgeted amounts and actual expenditures.

Compare your actual expenses with what you planned in your budget. Note any areas where you may have underestimated or overestimated costs. This could include groceries, entertainment, or discretionary spending categories.

Look for recurring patterns in your spending habits. Are there months when you consistently overspend in certain categories? Understanding these patterns enables you to make informed adjustments to your budget.

If you find that you consistently overspend in a particular category, consider reallocating funds from less essential areas or increasing your budget allocation for that category. Conversely, if you consistently underspend, redirect those funds towards savings or debt repayment.

Be proactive in adjusting your budget to accommodate life changes such as job transitions, changes in income, or unexpected expenses. Update your budget accordingly to reflect new financial priorities and realities.

Remember, a budget is a dynamic tool that should evolve with your financial situation and goals. Stay flexible and open to making adjustments as needed to ensure your budget remains effective and aligned with your financial objectives.

By actively monitoring your spending and making timely adjustments, you’ll strengthen your financial discipline and make steady progress towards achieving your financial goals.

Saving for the Future

Beyond day-to-day expenses, budgeting involves preparing for future aspirations and unforeseen circumstances. Utilise innovative savings apps like Hervest and Herconomy which specialise in target savings, impact investments, and financial empowerment for women. These apps provide tailored financial solutions to align with your goals and values, ensuring financial security and supporting future adventures.

Budgeting is a powerful tool for taking control of your finances and achieving your financial goals. You can create a more secure and prosperous future by tracking your income and expenses, setting goals, and utilizing innovative savings apps.

Read More:

How to Create a Budget in 10 Easy Steps

How the 50-30-20 Budget Rule Can Save Your Finances

How to Budget Money in 5 Steps

A Step-By-Step Guide For Creating a Monthly Budget

If, for some weird reason, you’ve never heard of 21 MAG, allow us to introduce ourselves;

Our mission is to centre the narrative on African women by cultivating content, community and culture for them to learn, grow and thrive. We recognise the significance of shaping women’s portrayal in media and aspire to serve as a platform for exploring questions about identity, aspirations, and personal journeys. From stories on asexuality to navigating life as a blind Nigerian woman, we chronicle Nigerian youth culture through the distinctive perspective of Nigerian women.

Follow Us on Socials: We’re on Instagram, Facebook, Twitter, Pinterest, Apple Music & Spotify.